Calendar Options Spread – Calendar spread indicate what is the gap in prices of two different expiry contracts of a particular commodity. This shows whether that commodity is moving in contango or backwardati . You can also reduce or increase the notional amount or number of contracts involved in an existing calendar spread. Stock options consist of financial contracts that give the holder the right .

Calendar Options Spread

Source : www.investopedia.com

Calendar Spread Definition: Day Trading Terminology Warrior Trading

Source : www.warriortrading.com

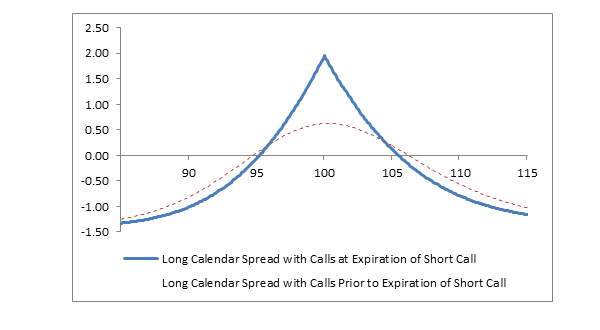

Long Calendar Spread with Calls Fidelity

Source : www.fidelity.com

Long Calendar Spreads for Beginner Options Traders projectfinance

Source : www.projectfinance.com

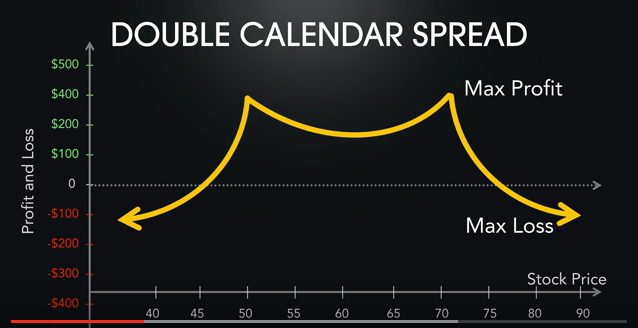

The Double Calendar Spread

Source : www.options-trading-mastery.com

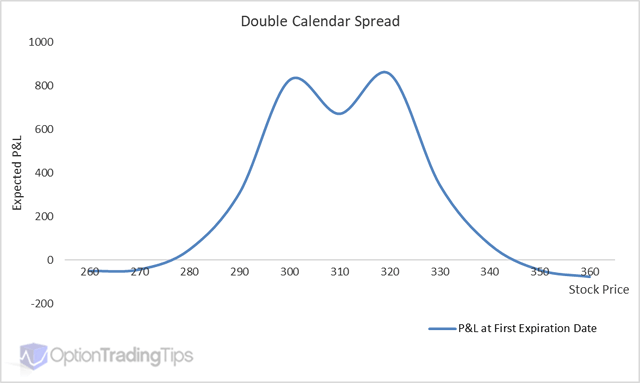

Double Calendar Option Spread

Source : www.optiontradingtips.com

options Understanding the visual representation of a Calendar

Source : money.stackexchange.com

Long Calendar Spreads Unofficed

Source : unofficed.com

Option Calendar Spreads CME Group

Source : www.cmegroup.com

Calendar Spread Options Trading Strategy In Python

Source : blog.quantinsti.com

Calendar Options Spread Calendar Spreads in Futures and Options Trading Explained: He wrapped up a winning calendar spread on Meta (META) and assessed potential strategies in other stocks like Boeing (BA) and IWM. The host highlighted the importance of considering earnings when . This article will focus on the Heating Oil calendar spread. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT .

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)